Corporate GovernanceLegislative & Regulatory Quick Links |

||||||||||||||

|

You can Button Bookmark this App and add it to the

Home Screen on your phone. Click here to read more.

|

||||||||||||||

|

Director's Liability

The office of directorship attracts certain statutory liability that attaches to a director in the performance of his delegated services. The overarching obligation of a director is to act in good faith and the best interests of the company at all times. This includes actively avoiding a conflict of interest.

A director is required to conduct himself with the degree of care, skill and diligence reasonably expected of a person having the general knowledge, skill and experience of that director. Additionally, a director is required to disclose any personal financial interests in any matter before the company as he/she may not use his/her board position to make a secret profit or gain an advantage for himself/herself which causes harm or is detrimental to the company. It is therefore of great importance that a company’s board of directors is made up of competent individuals.

While it is possible through the procurement of insurance policy/ies to indemnify an offending director in certain circumstances, a company may not indemnify a director for wilful misconduct, breach of trust, reckless or insolvent trading or for perpetuating a fraudulent act.

To adequately protect individuals holding the office of directorship, it is, imperative that the delegated authority of a board function to a board member is expressly known, documented and regulated internally. This will also serve at clarifying any disputes at law as to whether the director knew or reasonably ought to have had knowledge on the matter at issue.

|

||||||||||||||

|

|

||||||||||||||

|

||||||||||||||

| Useful Document Quick Links | ||||||||||||||

|

||||||||||||||

|

||||||||||||||

| Quick Links to Regulations | ||||||||||||||

|

||||||||||||||

|

||||||||||||||

|

Quick Links to Legislation Online

|

||||||||||||||

| Acts Online | ||||||||||||||

.png) |

||||||||||||||

|

|

||||||||||||||

|

||||||||||||||

|

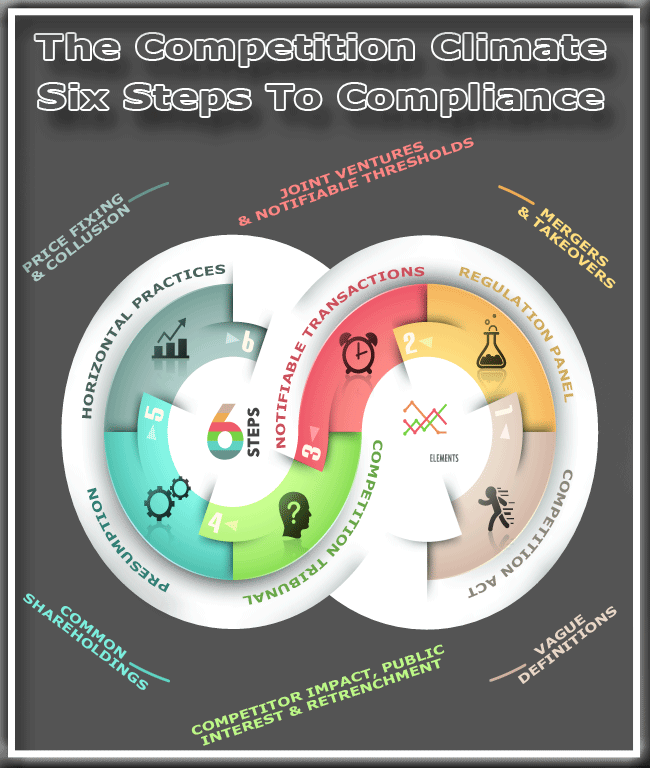

The competition climate in South Africa is fairly heavily regulated, with prevailing competition laws being enforced and developed by the Competition Commission together with the Competition Tribunal and the Takeover Regulation Panel. In enforcing its mandate, the Commission prohibits certain activities between competitors (so-called “horizontal practices”), such as price fixing and collusion.

The competition legislation goes as far as to presume the presence of these prohibited activities, where certain common shareholding exists between entities. While the prevailing competition legislation defines transactions that require prior notification and/or approval of the Commission, determining whether a transaction should be notified to the Commission can be confusing, owing largely to the wide definition of “merger” in the Competition Act. For example, a joint venture arrangement (whether incorporated or not) which meets the notifiable financial thresholds will require Competition Commission approval. Moreover, the approval of the Takeover Regulations Panel will be required to be obtained in circumstances where, pursuant to an intended merger, more than 10% of the entity’s shares have been disposed of within the previous 24 month period.

The Competition Tribunal will approach approval requests by among other things, determining the likely impact of the proposed transaction on competition in the relevant market. Additionally, the Commission will evaluate whether any public interest issues arise from the proposed transaction. A matter of public interest would, for example, include a circumstance where the purposed transaction results in a retrenchment of a class of employees.

|

||||||||||||||

.png) |

||||||||||||||

|

Share & spread the word:

|